Content

A good way for individuals to invest in natural gas is to purchase shares in natural gas mutual funds. Further, mutual funds which focus on natural gas distribution provide exposure to the growing demand for natural gas while limiting exposure to negative trends affecting other energy companies. Kinder Morgan Inc. is one of the largest U.S. energy infrastructure companies, with pipelines that transport natural gas, crude oil, gasoline and carbon dioxide. Its terminals store renewable fuels, chemicals, petroleum and other products.

- Some may track the performance of natural gas futures contracts, while others may invest in a basket of stocks involved in the natural gas industry.

- You can also purchase these private offerings through best-efforts private placements, overseen by a placement agent.

- The hypothetical example does not represent the returns of any particular investment.

- Henry Hub Natural Gas futures contracts are offered through NYMEX on the Globex® trading platform and are available to trade electronically through Schwab nearly 24 hours per day, 6 days per week.

- Kinder Morgan Inc. is one of the largest U.S. energy infrastructure companies, with pipelines that transport natural gas, crude oil, gasoline and carbon dioxide.

The amount you need in your account to day trade a natural gas ETF depends on the price of the ETF, your leverage, and position size. In the US, the Energy Information Administration (EIA) produces the Natural Gas Storage report that measures the weekly change in the number of cubic feet of natural gas held in underground storage. City Index is one of the best brokers for trading natural gas as a spread bet or CFDs.

A vast quantity of information bombards the market each day to create minute price moves, which, over time, lead to price ‘trends’. If you want to include natural gas in your investment portfolio, consider working with a financial advisor. How taxes are imposed on oil and gas varies by state in the United States. Generally, this can be done by taxing a portion of the market value, the volume produced, or some combination. In many states, tax benefits, exemptions, and credits have been implemented to ensure that extraction from specific types of wells is encouraged or discouraged. This occurs anytime a dividend-paying company reduces the number of dividends it pays, cuts high dividend yields, or stops paying dividends.

$0 online listed equity trade commissions + Satisfaction Guarantee.

This is another big player in the oil industry focused on exploration and production. Its activities are mainly finding and producing oil and natural gas. Companies that provide oilfield services typically supply drilling equipment, gas/oil well construction, and other support services.

While that assumes competitive natural gas pricing at early 2022 levels, the company also uses hedges to help mute the impact of volatility. The natural gas export company plans to allocate this cash flow for dividend payments (which it initiated in late 2021), repurchasing shares, paying down debt, and funding Corpus Christi Stage 3. Its balanced capital allocation plan should enable Cheniere to create significant value for its shareholders in the coming years. You can short natural gas through futures, options, spread betting and CFD trading to potentially profit from price falls as well as increases. Nat gas swing trading is a trading strategy designed to exploit price swings. Natural gas prices are notoriously volatile – even before the disruption caused by Russia’s invasion of Ukraine.

Key Types of Natural Gas ETFs

In this article, we’ll showcase a couple of picks that could be of interest to readers. It is fully integrated and operates in various sectors of the oil and gas industry. These include upstream, midstream, and even downstream distribution of products to consumers.

The most heavily traded contract, preferred by day traders, is the Henry Hub Natural Gas Futures (NG). Each contract represents 10,000 million British thermal units (mmBtu). Hargreaves Lansdown provides access to a wide range of companies with exposure to natural gas.

Types of Natural Gas Investment

They offer some good performing trading signals through their SMART Signals feature and also post-trade analytics so you can see where you trade profitable trade natural gas. GLDX, SDCI, UDI, UMI, USE and ZSB shares are not individually redeemable. Individual investors must buy and sell GLDX, SDCI, UDI, UMI, and ZSB shares in the secondary market through their brokerage firm. Weather and economic conditions impact the price and availability of natural gas. China, the major importer of natural gas, is trying hard to grow its economy and it’s going to need a lot of natural gas. The risk of estimating the reserves and the volume of hydrocarbons being produced cannot be ignored.

The key is finding natural gas stocks that can benefit from the sector’s long-term growth potential while also being able to weather the inevitable storms of volatility. Investing in natural gas infrastructure companies that own pipelines and LNG export facilities is an alternative. Infrastructure companies should benefit from growing gas demand without direct exposure to pricing. In addition, infrastructure companies tend to pay attractive dividends.

When calculating the daily movement of the average price of the 12 contracts, each contract month is equally weighted. The natural gas contract is natural gas delivered at the Henry Hub, Louisiana, and is traded on the NYMEX. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries.

Oil and Gas Investment Redefined

Higher prices due to strong demand when supplies are tight puts upward pressure on them. Invest in enough oil and gas wells that yield 3-15% anticipated net return per month and accredited investors can begin realizing how it is possible to obtain 50% or better net annual returns before payback. The likeliest scenario is that natural-gas prices will rise, given that oil prices have already surged more than 60% since March. Gas prices, meanwhile, have been flat since then, and are down by two-thirds since the summer of 2008.

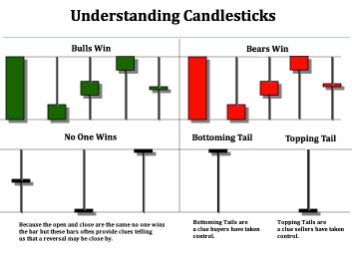

These are the natural gas stocks that had the highest total return over the last 12 months. Southwestern Energy Co. is a natural gas exploration and production company. The company focuses on developing natural gas and natural gas liquids in Pennsylvania, https://g-markets.net/helpful-articles/candlestick-chart-in-excel/ Ohio, West Virginia and Louisiana. Through problems with the China coal supply and lack of other energy sources, China has begun to hedge with supplies of liquid LNG, which has caused the demand in the natural gas market to rise sharply recently.

It also includes the cost of cleaning the environment and damage to wildlife. These costs affect profitability and represent a risk for oil producers that must not be ignored. This company also has a strong financial profile and a vertically-integrated, large-scale operating base.

Shell is also active in renewable energy, including biofuels and hydrogen. Online trading is also the easiest, has the most favorable charges conditions and allows you to customize your personal investment strategy by choosing CFDs on natural gas, shares of natural gas stocks or ETFs. Trading natural gas is speculative and only the moves of the gas price are important here. Gas CFD a financial contract that you trade to earn the price difference between your open and closed positions, without physical delivery of natural gas. It’s also a good option for investors, who like high risk ventures and dynamic trading.

If you would like to not only consume but also invest in natural gas, consider the options e360 Power has for you. The United States 12 Month Natural Gas Fund LP (UNL) and the United States Natural Gas Fund LP (UNG) are the only natural gas ETFs that trade in the U.S., excluding inverse and leveraged funds. Natural gas is primarily used for residential and commercial heating and cooling. And, as of January 2020, natural gas is also the largest source of US electricity production, accounting for over 37% of the total. The U.S. Energy Information Administration forecasts that electricity will increasingly be generated by renewables and natural gas while coal use falls.

You can write natural gas options but that entails further specialised knowledge and experience. In case natural gas prices remain high or do even continue to grow over the coming months, TGP could be able to charter out these ships at higher rates compared to current contracts. It should, however, be noted that most of TGP’s charter days are fixed in 2022, thus the exposure to a potential bull market for LNG ships is less pronounced compared to FLNG, for example.